The Role of Cryptocurrency in Money Laundering and Financial Crime

The Role of Cryptocurrency in Money Laundering and Financial Crime

What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that utilizes cryptography for secure financial transactions, control the creation of additional units, and verify the transfer of assets. One of the most well-known cryptocurrencies is Bitcoin, but there are many others like Ethereum, Ripple, and Litecoin.

How are Cryptocurrencies Used for Money Laundering?

Cryptocurrencies have gained popularity in the world of money laundering due to their decentralized nature and a certain degree of anonymity they offer. Here are some ways cryptocurrency is used for money laundering:

Mixing Services or Tumblers

Mixing services, also known as tumblers, are online platforms that facilitate the mixing of cryptocurrencies from different sources. By using these services, individuals can obfuscate the origin of funds and make it difficult to trace the flow of money, aiding in money laundering activities.

Offshore Exchanges

Offshore cryptocurrency exchanges operate in jurisdictions with lax regulations or minimal legal requirements. These exchanges allow individuals to deposit and withdraw large sums of money with minimal scrutiny, making them attractive for money laundering purposes.

Peer-to-Peer Trading

Peer-to-peer trading platforms enable individuals to buy and sell cryptocurrencies directly with one another, bypassing traditional financial institutions. This method can facilitate money laundering by allowing individuals to convert illicit funds into cryptocurrencies and then sell them for clean money.

How Can Cryptocurrency be Used in Financial Crime?

Apart from money laundering, cryptocurrencies can also be utilized in various financial crimes. Here are a few examples:

Ponzi Schemes

Cryptocurrencies have been used as a basis for Ponzi schemes where individuals are promised unrealistic returns on their investments. These schemes rely on the continuous recruitment of new investors, who are paid through funds deposited by subsequent investors. Eventually, the scheme collapses, leaving the majority of investors at a loss.

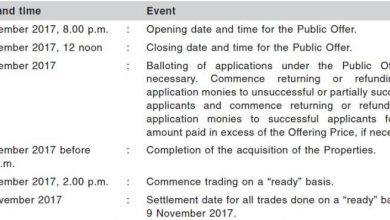

Initial Coin Offering (ICO) Fraud

ICOs have become a popular fundraising method in the cryptocurrency world. However, many fraudulent ICOs have emerged, where individuals create fake projects, collect funds from investors, and disappear with the money. This has led to significant financial losses for unsuspecting investors.

How are Authorities Addressing Cryptocurrency-Related Crimes?

Enhanced Regulation

To tackle the misuse of cryptocurrencies, authorities across the globe are implementing enhanced regulations. These regulations often involve strict KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements for cryptocurrency exchanges and service providers.

Blockchain Analytics

Blockchain analytics companies are emerging as an essential tool in combating cryptocurrency-related crimes. These companies specialize in analyzing blockchain transactions to detect suspicious patterns and identify illicit activities. By collaborating with law enforcement agencies, they help track down criminals using cryptocurrencies for illicit purposes.

FAQs:

Q: Is cryptocurrency inherently illegal?

A: No, cryptocurrency itself is not illegal. It is a technology that can be used legally for various purposes. However, its decentralized nature can make it susceptible to misuse, including money laundering and financial crimes.

Q: How can individuals protect themselves from cryptocurrency-related crimes?

A: Individuals can protect themselves by using reputable cryptocurrency exchanges, implementing strong security measures such as multi-factor authentication, and being cautious of investments that promise unrealistic returns.

Q: Can transactions with cryptocurrencies be traced?

A: While cryptocurrencies offer a degree of anonymity, all transactions are recorded on the blockchain. Blockchain analytics tools can assist in tracing transactions and identifying the individuals involved, making it increasingly difficult for criminals to remain anonymous.

In conclusion, while cryptocurrencies have brought innovation to the financial industry, their decentralized nature and anonymity can make them attractive for money laundering and financial crimes. However, authorities are actively implementing regulations and utilizing tools to combat these illicit activities and promote the legitimate use of cryptocurrencies. It is imperative for individuals to stay informed, exercise caution, and use reputable services to protect themselves from cryptocurrency-related crimes.